Europe, the world’s second-largest cryptocurrency economy, is preparing to allow property deals and pay taxes using crypto assets.

Europe is emerging as a leading player in the innovative crypto market, enforcing digital assets utilization in property deals and tax paying. Cryptocurrencies are becoming widely regulated in the European market, with Crypto-Assets Regulation (MiCAR) expected to come online on January 1, 2025.

Switzerland is already accepting digital assets for paying taxes, leading the European market into the crypto finance race.

Property Deals Become Easy With Crypto Assets

The Boston Consulting Group forecasts that by 2030, the market for “tokenization,” turning physical assets into digital tokens, could reach $16 Trillion. Europe’s upcoming regulations in 2025 might impact investor interest in this area.

The largest crypto property deal involved two Bahamian islands, purchased for over $500 Million with Unicoin, a cryptocurrency from Unicorn Hunters, a firm investing in high-potential startups.

Europe, particularly Spain, Thailand, and Portugal, is at the forefront of properties sold for cryptocurrency. Silvina Moschini, founder of Unicorn Hunters, discussed the volatile crypto investment scene and her real estate ventures with Euronews.

In February 2024, Unicoin solidified its positioning in the crypto market by acquiring prime Bahamas Land with cryptocurrency. This is considered one of the most significant real estate transactions that involve digital assets.

Over 1,108,863,283 Unicoin worth $554,431,641 were paid over the deal.

Is It Possible To Pay Taxes Using Cryptocurrency?

Paying taxes or buying coffee using digital assets is no more a big deal in Switzerland.

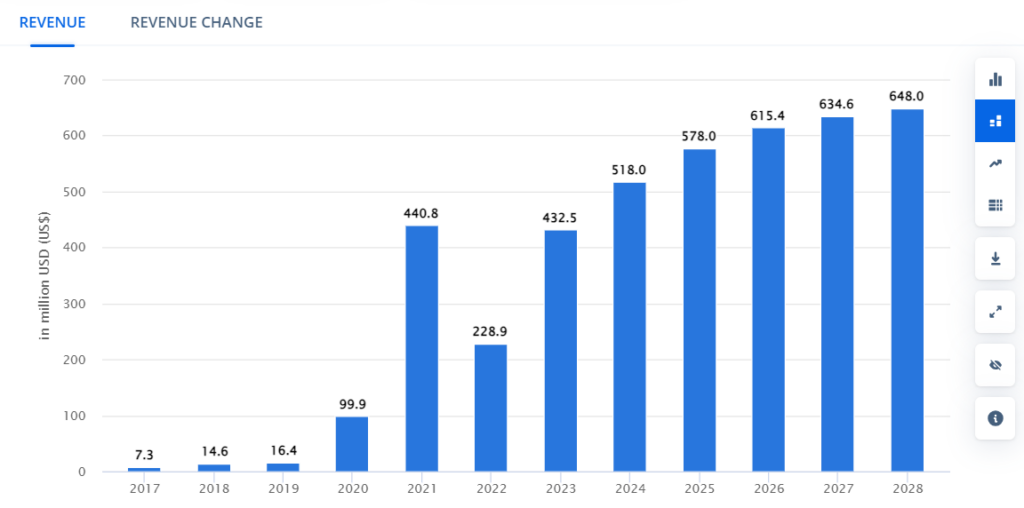

According to Statista, Switzerland’s crypto market generated around $432.5 million annual revenue in 2023 and is projected to hit $578.0 Million by 2025.

Switzerland Cryptocurrency Market Revenue I Source: Statista

The United States has topped the list with an estimated annual revenue generation of over $18 billion in 2023 and is supposed to hit $33 billion by 2028.

Moreover, the European market is all set to give tough competition to the US market, not only in revenue generation but also in tax paying and property deals using cryptocurrencies.

On January 1, 2025, with the arrival of Markets in Crypto-Assets Regulation (MiCAR) over online platforms, the crypto assets will become regulated in the European market. The European Union approved MiCA in June 2023 to promote financial stability.

Ilya Volkov, a Crypto Valley Association board member, discussed crypto at the NGO’s Web3 Banking Symposium in Geneva last week.

“Europe became one of the leaders here, especially when we speak about this framework for regulation of crypto assets,” said Ilya Volkov.

Cryptocurrency Acceptance in the European Marketplace

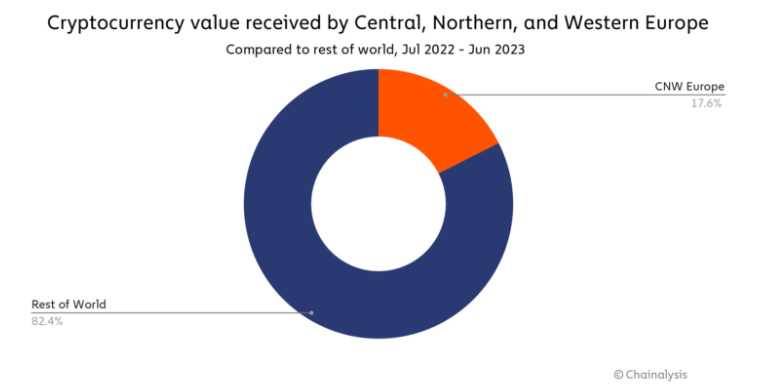

Europe is positioned as the second-largest cryptocurrency economy, accounting for over 17.6% of global transaction volume, and has become a key player in the innovative Crypto market.

According to Chainalysis, between July 2022 and June 2023, Central, Northern, and Western Europe received over 17.6% of global transaction volume. The rest of the world received around 82.4% in transaction volume.

Cryptocurrency value received by CNW Europe I Source: Chainalysis

In the same way, decentralized finance (DeFi) and centralized exchange are the most significant service categories in CNW Europe, accounting for 54% and 46%, respectively.

Adarsh Singh is a true connoisseur of Defi and Blockchain technologies, who left his job at a “Big 4” multinational finance firm to pursue crypto and NFT trading full-time. He has a strong background in finance, with MBA from a prestigious B-school. He delves deep into these innovative fields, unraveling their intricacies. Uncovering hidden gems, be it coins, tokens or NFTs, is his expertise. NFTs drive deep interest for him, and his creative analysis of NFTs opens up engaging narratives. He strives to bring decentralized digital assets accessible to the masses.

Home

Home News

News