Forbes recently classified 20 blockchains as zombies because they had billions of valuations despite having little utility.

Zombies are dead human beings that linger around for as long as time itself. For blockchains and their cryptocurrencies, the concept of a “zombie blockchain” is new and an interesting one too.

The global cryptocurrency market at press time stood at a valuation of $2.3 Trillion. Bitcoin and Ethereum constitute 69.9% of the market, with a substantial user base. Bitcoin has over 460 million addresses, of which 37% are economically relevant, while other addresses belong to exchanges.

Meanwhile, looking at some of the blockchains with the most active addresses according to Trading View goes on to show that Tron, Bitcoin, Ethereum, Litecoin, Stellar, and others have made it to the list. These numbers show a rather vibrant ecosystem for some of the top cryptos screaming that crypto is far from over.

However, in the recent report by Forbes, they released a list of 20 Zombie blockchains, including prominent names like ETC, ADA, XRP, LTC, BCH, and more. Let’s Have a look into these Zombie Blockchains.

What Are Zombie Blockchains?

Zombie blockchains are described as “ low utility, high trading” assets. Forbes described 20 blockchains as a zombie because they have a Billion-dollar valuation and low utility.

Forbes named the following networks as crypto zombies: XRP (XRP), Cardano (ADA), Bitcoin Cash (BCH), Litecoin (LTC), Internet Computer (ICP), Ethereum Classic (ETC), Stellar (XLM), Stacks (STX), Kaspa (KAS), Fantom (FTM), Monero (XMR), Arweave (AR), Algorand (ALGO), Flow (FLOW), MultiversX (EGLD), Bitcoin SV (BSV), Mina (MINA), Tezos (XTZ), Theta (THETA), and EOS (EOS).

These blockchains have a low number of developers and significantly less fee collection. Cardano, one of the zombie blockchains mentioned by Forbes, has 27.7k daily active addresses, which are continuously declining. If we look at other metrics like fees, revenue, DEX volume, and daily transactions, Cardano ranks further below its L1 peer.

Cardano has an average fee collection of $6.7k, while the L1 average is around 605k, as per the data provided by Artemis. Weekly core active developers on the platform are 150, which is high compared to other L1 blockchains, as per the data provided by Artemis.

Is Forbes Missing Something?

Cryptocurrencies like Litecoin, Bitcoin Cash, XRP, and others have been present for a long time despite being called dead at various times. Before looking analytically at these chains, let’s look at NVT.

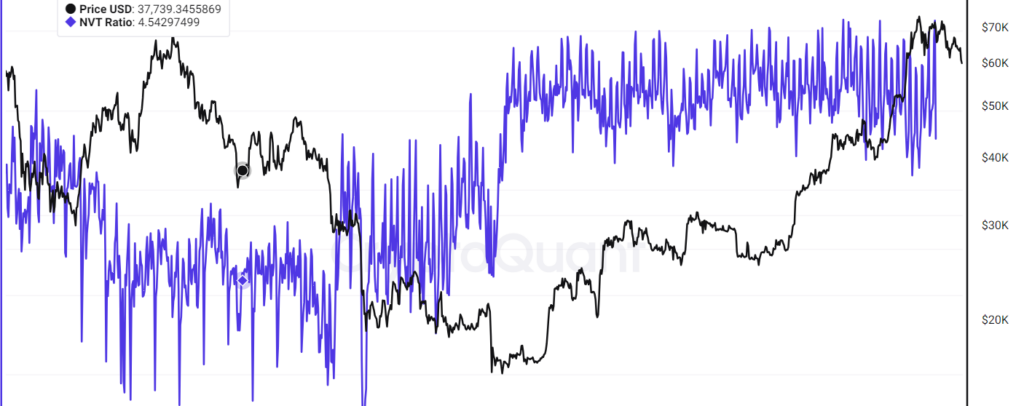

Network value to transactions, or NVT, is one of the key ratios in crypto economics, and it is very similar to the PE ratio in traditional finance. It measures the relationship between a crypto asset and the value of a transaction on its network.

Chris Burniske and Willy Woo popularized this ratio. It helps identify potential price bubbles in cryptocurrencies by assessing whether valuation aligns with underlying fundamentals, particularly transaction activity.

If we look at Bitcoin, it has an Adjusted NVT of 217, while ETC has an NVT of 270, as per the data provided by Messari. Looking at the overall data of these blockchains’ adjusted NVT, we find that ETC is significantly overvalued as the network has more value than actual transactions. Meanwhile, assets like ADA, KASPA, and ICP have low NVT, implying that the transaction value on the network is growing at a relatively higher pace than others.

If one considers NVT equivalent to PE in traditional finance, we can find that the list has various assets that are just in hibernation and not zombies.

The Pump And Dump

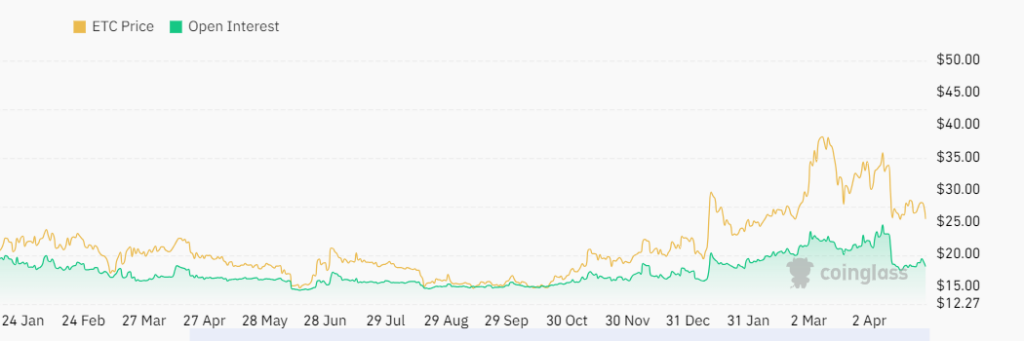

One of the major reasons for these cryptocurrencies being Zombies is the large holders’ pump of the tokens. If we look at Ethereum classic, it has a market cap of over $3.5 Billion despite producing a revenue of 30-35ETC in the past two weeks.

Meanwhile, its Open Interest has been increasing steadily since the start of 2024 and has reached $170 million. Recently, XRP has observed a surge of over 55% in the intraday trading volume of Options, reaching $1.3 Billion. Similarly, other Zombie crypto assets have been seeing a rise in their overall trading volume and Open Interest despite producing significantly less intrinsic value.

Adarsh Singh is a true connoisseur of Defi and Blockchain technologies, who left his job at a “Big 4” multinational finance firm to pursue crypto and NFT trading full-time. He has a strong background in finance, with MBA from a prestigious B-school. He delves deep into these innovative fields, unraveling their intricacies. Uncovering hidden gems, be it coins, tokens or NFTs, is his expertise. NFTs drive deep interest for him, and his creative analysis of NFTs opens up engaging narratives. He strives to bring decentralized digital assets accessible to the masses.

Home

Home News

News